Her body was tired, she couldn’t switch hospitals her bills accumulated. Insurance had forsaken her, an estate in shambles.

Find out what we did…

A woman was suffering from Stage 4 Cancer for over 4 years. She went to the same hospital and saw the same doctors throughout her illness. In 2016, state insurance coverage would no longer cover any treatments, visits or services rendered at that hospital. She went there for over 3 years without a problem. Suddenly, even with the same insurance policy, she was denied coverage at that hospital. In 2016 they would no longer accept her insurance and would not cover her going there at all. She would get bill after bill. The stress of the situation was debilitating on her and her family. Her health was deteriorating rapidly.

She was too sick to find another policy, too ill to move to another hospital, and finding new doctors at this stage was hopeless and worrisome. She reached out to Medwise Insurance Advocacy for help.

The delicate balance and intricate workings between health insurance carriers, healthcare providers and the insured requires an understanding of how it all comes together. Such an understanding facilitates the ability to detail extenuating circumstances that require exceptions and exemptions.

In practice, Medwise Advocacy is based on knowing the intimate details of the healthcare dynamic. Politicians were called. In May, the State Department of Insurance was just not helping her and by the end of August the case was still held up. Medwise reached out to the Attorney General.

The woman was so scared of these bills and how her estate would affect her family, The stress continued to mount, her body started to give up and sadly, she died on Oct. 15th. Medwise continued to fight for her and the case was settled about 3 weeks after she passed. Coming in close to 1 million dollars, the hospital was paid in full. The case was put to rest because of the involvement of politicians, the Attorney General and the zealous advocacy of Medwise.

It was such a relief to her friends and family that these bills were paid. The advocacy and negotiation that facilitated a paid settlement for her medical costs eradicated unfinished business. If only the relief of settlement was felt during the patient’s life. Don’t wait for medical bills to pile up, let’s immediately negotiate a solution.

In America, medical insurance coverage is a hybrid of private healthcare providers, massive insurance companies, and governments at the state and national levels. Medwise Insurance Advocacy is here to help sort it all out.

“This book is amazing! I used the information in this book to help figure out if my mom was being ripped off by various doctors. This offers a step by step guide on how to deal with it. I used it to save over $5400 with just one phone call and reading some of the text to the person on the other end of the line. It only took one phone call! There are tons of strategies, tips and tricks on how to deal with all the bills you get when it comes to healthcare. I highly recommend this book. It’s VERY good.”

-Verified Amazon Purchase Review

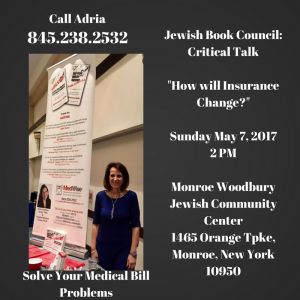

Upcoming Event:

Hear my critical talk about how to avoid getting ripped off by insurers, medical providers and the government, as explained in my book, “Solved! Curing Your Medical Insurance Problems” and also learn about how all the rules may change very soon.

If the plans for Obamacare change, what is heading our way? Will there be more denials for healthcare? Will pre-authorizations and referrals be required on most medical plans? Will Medicare policies all be Medicare Advantage Plans since the government is looking to have privatized health insurance?

Too often consumers find themselves paying much more money than they expected, getting much less than they bargained for. Medical care is no exception. My book and astute discussions show readers how to spot over-charges by providers, under-reimbursements by insurers, and inappropriate denials by insurers and government employees

I feel needed now more than ever!!

MAKE SURE NOT TO MISS MY talk about what to do to protect yourself in these uncertain times.

“I had the good fortune to speak with Ms. Gross on some insurance issues that were plaguing me, and she recommended that I buy her book. Thanks to the advice of Ms. Gross, over both the phone and in print, I was able to successfully negotiate my unreasonable hospital bill down by a significant percentage. There is a lot of good, specific advice here, such as Medicare look-ups for billing codes in your hospital bill, and healthcare specific negotiation tactics. And of course, any specific questions can always be addressed to Ms Gross. I found her to be very open and helpful, more so than other authors I’ve tried to contact”

– Verified Amazon Purchase Review